Shanghai Real Estate News

Home >Shanghai Real Estate NewsStructure up, but are we constructing as well countless houses?

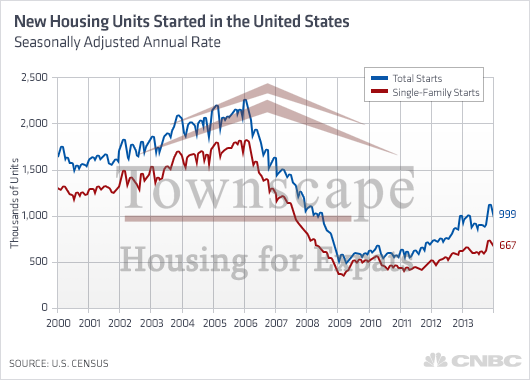

The year-end numbers are in, and Residence construction improved dramatically in 2013. Both single-

and multi-Family members housing starts were up, by 15 and 25 percent, respectively, according to the

U.S. Census. Include it all up and Complete housing construction rose 18 percent from 2012 to the

highest level since 2007.

Now for a little perspective. Final year was the best year for single-Family members Residence construction

since 2009, but that's not saying much since it also was fifth worst on record. Single-Family members

starts came in at just under 618,000. Compare that to the height of the housing boom in 2005,

when 1.7 million single-Family members Residences were Constructed. The historical average is Appropriate around a

million, so we're barely half way back.

That perspective might make some say we still need to ramp up construction Much more, Develop Much more

Residences. The nation's Residence Developers would certainly say that. Or are we Developing about enough? Or

even As well much?

"The vacancy Level has been declining, which means we are building Much less than the number of new

households," said Jed Kolko, chief economist at Trulia. "But the vacancy Level is still higher

than it was before the bubble, which means we should be building fewer Residences than the Progress in

households, because there still is an excess of vacant Residences."

Empty houses, either owned by the Financial institutions or investors, are still a blight to many communities and

are still keeping Residence prices from recovering fully. There is also a huge surge in rental demand.

Although some of that is in the single-family market, the bulk is in multifamily apartments.

Developers are Properly aware of that.

Multifamily apartment construction is surging A great deal Much more than single family. At just under

292,000 units started, construction Amount is now Practically three times what it was in 2009 and

right around the 10 12 months, prerecession average. What has changed, however, is the purpose of

these apartments. During the housing boom, Much less than 60 percent of these structures Have been Constructed as

rentals. More than 40 percent Have been sold as condominiums. Today, 92 percent of multifamily Begins

are intended for rental, the highest since the Census began tracking this Information set in 1974.

"Rents won't rise as A great deal as you might think, given the growing rental demand, because there is

all this new apartment rental supply that Need to come onto the market Up coming 12 months. Without the

increase in Begins, rent increases would be A great deal steeper," Stated Kolko.

Rent growth is already moderating, but home Selling price growth is still going Powerful, at Lowest for the

existing home market. The conundrum is that A great deal of that growth is fueled by all-cash investors.

These investors generally do not Purchase new construction. They tend to center on the lower end or

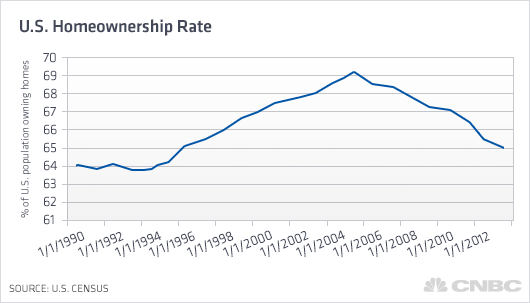

distressed market. The home ownership rate, which excludes investor properties, is still

declining, at 65.3 percent at the end of the third quarter of 2013, In accordance to the Census.

That's Comfortably from a peak of 69.2 percent in 2004. If you subtract the Practically 4.5 million borrowers

who are not current on their mortgages or who are in the foreclosure process, that rate is even

lower, In accordance to Black Knight Financial Services.

It begs the question, will new home sales meet new home Development? Will Need outweigh

Provide and allow builders to Carry on to raise prices? New home sales were running nearly 30

percent higher in November than in November 2012, but still about a third of what they were

Throughout the housing boom and Properly below historical norms. The two employment and inArrive growth are

still not Powerful, and job participation is way Right down. Still, some are hopeful for a turnaround.

"Builders are facing the headwind of rising Development costs, but buyer traffic has held up

Properly In spite of rising mortgage rates," said Patrick Newport of IHS Worldwide. "After hitting a plateau

in the middle of 2013, the market for new homes is poised for a Powerfuler 2014."

As home prices rise and more borrowers Arrive back into a Optimistic equity position on their

Components, more will choose to put their homes on the market; those existing homes will compete

with new Development. If there are enough Purchasers, home prices will hold or rise. If not, and

there are too many homes for sale compared to Need, prices will weaken.